capital gains tax news 2020

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to 434.

Capital Gains Full Report Tax Policy Center

But will the tax increase this year.

. News analysis and comment from the Financial Times the worldʼs leading global business publication. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Unlike the long-term capital gains tax rate there is no 0.

Add this to your taxable. Thats a potential increase of. 17 hours agoFor example lets say a retired couple has 30000 in tax-exempt interest 25000 of regular income and 75000 in long-term capital gains and dividends.

This condition can create complications for divorcing. That last tax break currently requires the transfer to be made during a tax year in which the couple are living together. Their gross income is.

CAPITAL GAINS TAX may see a huge hike in a bid to raise more money following the expense of the coronavirus pandemic. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Long-term capital gains taxes are assessed if.

Monday 16 November 2020. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Learn the ins and outs of the capital gains tax which you may owe if you sell stocks your home.

Basic Rules Investors and Others Need to Know. Browse Capital gains tax news research and analysis from The Conversation Menu Close Home. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

2022 capital gains tax rates. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Which rate your capital gains will be taxed depends.

How the 0 Rate Works. Top Stocks to Buy in 2022 Stock Market News Retirement. In this case their gross income is 125000 and taxable income is 98000.

New Hampshire doesnt tax income but does tax dividends and interest. The last few years have seen a number of changes to the UKs tax regime with the latest coming into force on April 6th 2020. Since the 27000 standard deduction exceeds the 25000 of regular income the 98000 is entirely.

The changes affect the Capital Gains Tax CGT. 2021 capital gains tax calculator. First deduct the Capital Gains tax-free allowance from your taxable gain.

In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single. You owe capital gains taxes on the profit that you make whenever you sell an investment asset or. Long-term capital gains taxes for 2020 tax year.

Capital Gains Tax 101. Furthermore a gift from an individual to. What are the main Capital Gains Tax CGT implications from April 2020.

The much more common way is through capital gains taxes. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Phil WalterGetty Images October 18.

A gift is a disposal for Capital Gains Tax CGT purposes. UK proposals to reform capital gains tax are. Capital gains taxes on.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Definition 2022 Tax Rates Examples

Guardian Financial Page Newspaper Headline Article 12 November 2020 Capital Gains Tax Overhaul Could Raise 14bn Review In London England Uk Stock Photo Alamy

Ippr On Twitter Good To Hear Rishi Sunak Is Reviewing Capital Gains Tax The Unfair Tax Means Income From Wealth Is Taxed Less Than Income From Work Thetimes Front Page Quotes

Statement Oklahoma Should Not Waste Millions On Capital Gains Tax Break To Protect Small Part That Might Benefit Agriculture Oklahoma Policy Institute

Gov Inslee Renews Push For Capital Gains Tax In Proposed Budget Mynorthwest Com

Ordinary Income Taxation Vs Capital Gains Taxation

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Capital Gains Tax In Spain Do I Need To Pay It And How Much

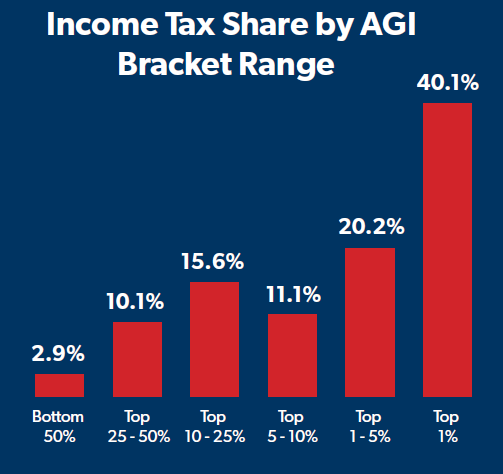

Who Pays Income Taxes Foundation National Taxpayers Union

Wealthy Would Dodge 90 Of Biden S Capital Gains Tax Increase Study Says Cbs News

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Who Pays Income Taxes Foundation National Taxpayers Union

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Laird Norton Wealth Management

What Are Capital Gains Taxes And How Could They Be Reformed

How Could Changing Capital Gains Taxes Raise More Revenue

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax